INSURANCES

- Referred to as cash-value or permanent insurance, that provides a death benefit that is a multiple of investment

- These types of insurance policies combine guaranteed death benefits with a savings component or cash value that is reinvested and tax deferred.

- The savings portion is accumulated throughout the life of the policy and can often be cashed in at some future point. The premiums invested are usually principal protected with guaranteed minimum crediting rates and average returns of 5 to 6%.

- Universal Life policies, if configured correctly, will pay the death benefit 100% of the time.

- Universal life insurance is often a good choice if you are on solid financial ground and would like to leave a legacy.

- Universal Life insurance can be a tax-favored investment vehicle:

- Income tax-free death benefit proceeds

- Income tax-deferred cash value accumulation

- Potential for income tax-deferred lifetime distributions

- Premiums paid can potentially be offset against the offshore capital gains

Product Overview

- Flexibility on Premium Payments:

- Single Pay (complementing the investment portfolio)

- Annual Payments (the insured chooses the preferred periodicity)

- Premium Finance (UB exclusivity, for premiums over $2MM)

- Flexibility on the Investment and Return of the Premium Accumulation:

- Current Rate (based on the average return of the carrier’s reserves)

- Indexed (based on equity indexes (i.e. S&P 500) but with principal-protection)

- Variable (managed investment portfolio based on a selection of mutual funds)

Premium Finance (Universal Life)

Universal Life Premium Financing*

- UB through its banking relationships enables the financing of up to 85% of the premium (indicated for policies with +$2MM premiums)

- Possibility of using an investment portfolio as a guarantee for the collateral and total financing of the policy in a non-recourse loan (policy itself as guarantee)

- Loans with competitive rates (fixed or variable) and annual payments reduced or even covered by income from the investment portfolio

- Customer benefits from the income and total accumulation of the premium invested in the policy

- Possibility for the family to use future deferred gains into the offshore to repay the loan principal, increasing the tax free death benefit.

- Substantial generation and multiplication of the legacy for the next generations

*United Brokers is not a bank and does not offer or provide loans. All premium financing information is being provided for informational and educational purposes only and is not guaranteed. Financing the premium involves a number of risks that must be carefully considered before using the loan proceeds to purchase a life insurance policy. Consult a bank professional for additional details on the applicable terms and risks. Not all insurers and products qualify for this operation.

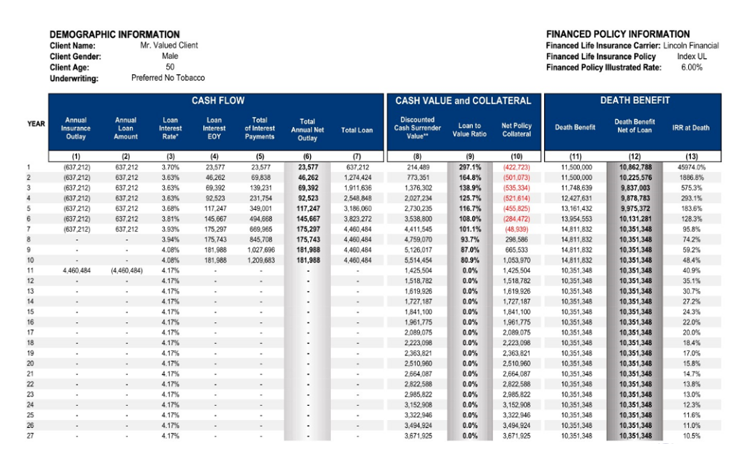

A – Example of an Investment Stragety associated with a Premium Financed Offshore Universal Life Insurance*

- Family has now tripled it’s liquid assets at succession!

- Cost of total policy financing: (4% of $2MM) = $80k/year

- Investment portfolio income (yielding 5% of $5MM) = $250k/year

- Gross average income accumulated in the policy (5.80% of $ 2MM/year)

B – Example of an Investment Strategy associated with a Premium Financed American Universal Life Insurance*

Examples of Universal Life Policies

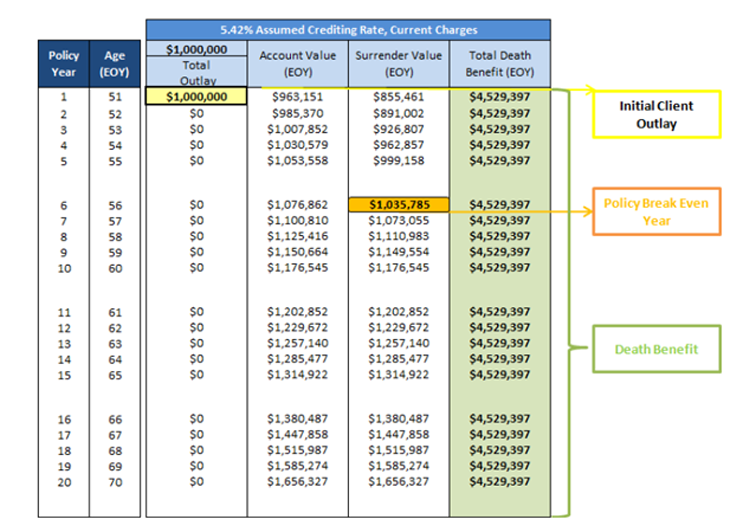

1 – Sample International Carrier – Indexed Universal Life Illustration Male, Non-Smoker, Super Preferred, Age 50

$1,000,000 Single Pay Premium – Cash Value to Endow at Age 100

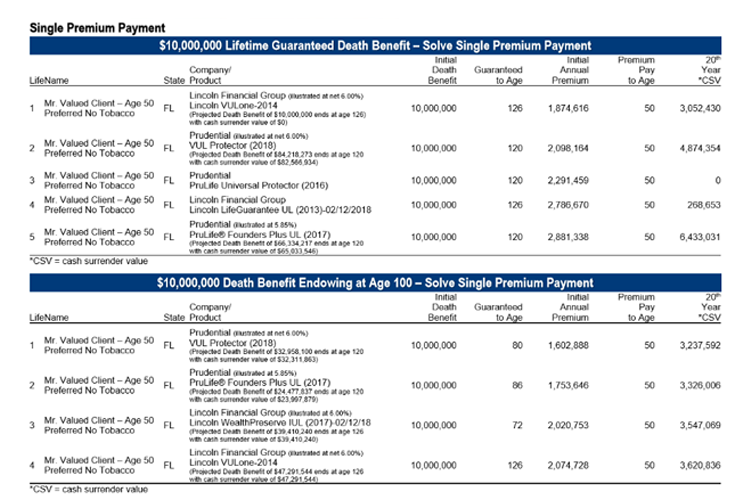

2 – Sample US Carrier – Indexed Universal Life Illustration

$10,000,000 Coverage – SINGLE PREMIUM – Cash Value to Endow at Age 100

3 – Sample US Carrier – Indexed Universal Life Illustration

$10,000,000 Coverage – 20 YEAR PREMIUM – Cash Value to Endow at Age 100

Why Contract an Universal Life Insurance?

Benefits of an Universal Life Insurance:

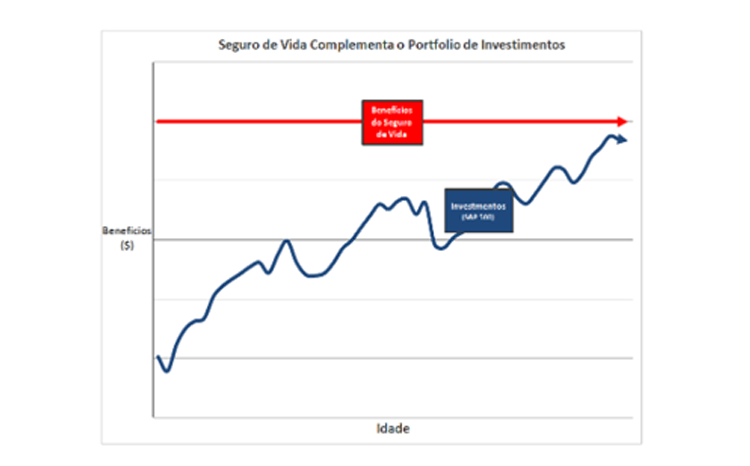

- Lifelong liquidity and immediate protection at the required size and time (life insurance benefits are non-correlated to the family’s other assets)

- Premiums are principal protected and invested at competitive yields with different investment options

- Diversification of country and currency risk, with asset protection on the premium and benefits

- Death Benefits are generally income, capital gain and estate tax exempt

- Flexibility in premium payment design, including single, annual or premium financing

- Many choices of insurers and jurisdictions

- United Brokers is an insurance boutique that represents our clients with total independence!

PPLI or Insurance Wrappers

- For affluent investors, usually the premiums (liquid and illiquid) start at U$10MM

- It is used in many cases as a substitute for a trust, private fund or foundation or to strengthen existing structures by adding ‘substance’. Many Tax authorities are looking through trusts and not accepting the trustees as the legal owner of the assets and this can cause difficulties that are not experienced when using PPLI.

- It’s designed to maximize savings and minimize the death benefit, but should be combined with an Universal Life or Term Insurance for added substance.

- Due to the unique nature of the relationship between the life company, the individual and the contents of the life policy, PPLI can be used to overcome specific issues such as management and control, beneficial ownership and substance.

- Since the life insurance company is recognized as the legal owner of the assets, in most cases they will also be outside the reach of creditors

- Protection and Privacy are a major feature of PPLI

- PPLI policies can be an invaluable resource for those seeking tax efficiency, a decreased reporting burden, asset protection or confidentiality

- Temporary, for a given period of time, anywhere from 10 years to 30 years, depending on the age of the insured, and they are non renewable.

- Is the most basic of insurance policies. It is nothing more than an insurance policy that provides protection for accidental death for a specified period of time.

- If you or your beneficiaries do not make any claims during the term the policy, it will typically expire worthless.

- Generally, term life insurance is cheaper to buy during the earlier years of life, when the risk of death is relatively low. Prices rise in accordance with increasing risks and advancing age.

- In a term insurance , there is a low probability that the death benefit will be distributed to the beneficiaries (less than 5% of the contracted policies will pay the death benefit).